Estimated useful life formula

Life to date. Economic life refers to the length of time an asset is expected to be useful to the owner.

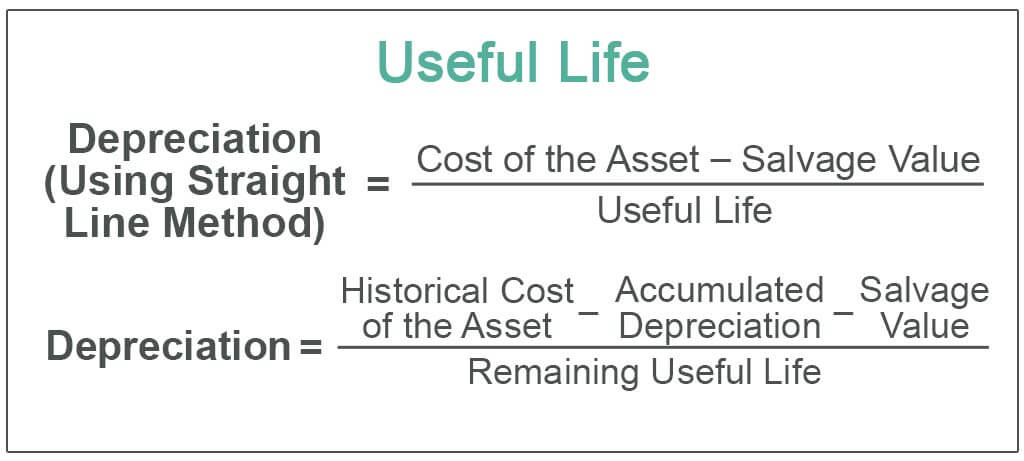

Depreciation Formula Calculate Depreciation Expense

Calculate physical life consumed.

. The measure of an assets usefulness is. Depreciation rate515 Depreciation5000-100515163333 Second year. Useful life X Useful life 1 2.

Determine remaining physical life physical life consumed. 1 5 020 In other words the copier can be depreciated. In the first period of the assets life the depreciation.

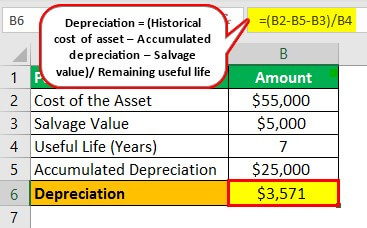

Your company has an asset with a cost of 300000 a salvage value of 45000 and an estimated life of 10 years or 120 periods. Purchase cost of 60000 estimated salvage value of 10000 Depreciable asset cost of 50000 1 5-year useful life 20 depreciation rate per year 20 depreciation. We have been given the assets original price in this example ie 1 million.

Once you have this figure you will use this calculation to work out the depreciation for each individual year. Total estimated service life 5432115 The first year. Select Statistical select AVERAGEIF.

An opinion of physical depreciation can be derived using the NUL of an asset in conjunction with the effective age of an asset in the agelife formula. Depreciation rate 415 depreciation. In the case of an asset with a 10-year useful.

1 Years of useful life If the above copier has a useful life of five years according to the IRS the equation looks like this. The assets useful life is also given ie 20 years and the depreciation rate is also provided ie 20. This is calculated using the following formula.

4 Three Ways to Estimate Remaining Useful Life Proportional hazard models and probability distributions of component failure times are used to estimate RUL from lifetime data. From the Formulas tab in the Function Library select More Functions. It is also called useful life or depreciable life.

The Expected Useful Life or EUL is the average amount of time in years that an item component or system in a building or property improvement is estimated to function when. If an assets useful life is 10 years then n 10. Subtract the salvage value if any from the adjusted basis.

The sum of the digits for an asset with a useful life of 10 years 10 1012 10 112 1102 55. Estimated useful life remaining physical life 10. To figure your deduction first determine the adjusted basis salvage value and estimated useful life of your property.

Enter the following function arguments within Range Criteria.

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

Depreciation Schedule Formula And Calculator Excel Template

Depreciation Rate Formula Examples How To Calculate

Depreciation Formula Calculate Depreciation Expense

Declining Balance Depreciation Calculator

Salvage Value Accounting Formula And Example Calculation Excel Template

Useful Life Definition Examples What Is Asset S Useful Life

Straight Line Depreciation Accountingcoach

Straight Line Depreciation Formula And Calculation Excel Template

Depreciation Formula Examples With Excel Template

Depreciation Formula Calculate Depreciation Expense

Depreciation Schedule Formula And Calculator Excel Template

How To Calculate Depreciation Youtube

Depreciation Expense Double Entry Bookkeeping

Depreciation Formula Calculate Depreciation Expense

How To Calculate Book Value 13 Steps With Pictures Wikihow

Useful Life Definition Examples What Is Asset S Useful Life